Discover the fascinating intersection of Bitcoin market psychology and the captivating influence of emotions in trading. This thought-provoking article unravels the intricate relationship between human emotions and the dynamic realm of Bitcoin trading. Our aim is to equip you with valuable insights and strategies to navigate the complexities of emotions, empowering you to make rational and well-informed choices in the ever-evolving cryptocurrency market.

Understanding the Impact of Emotions on Bitcoin Trading

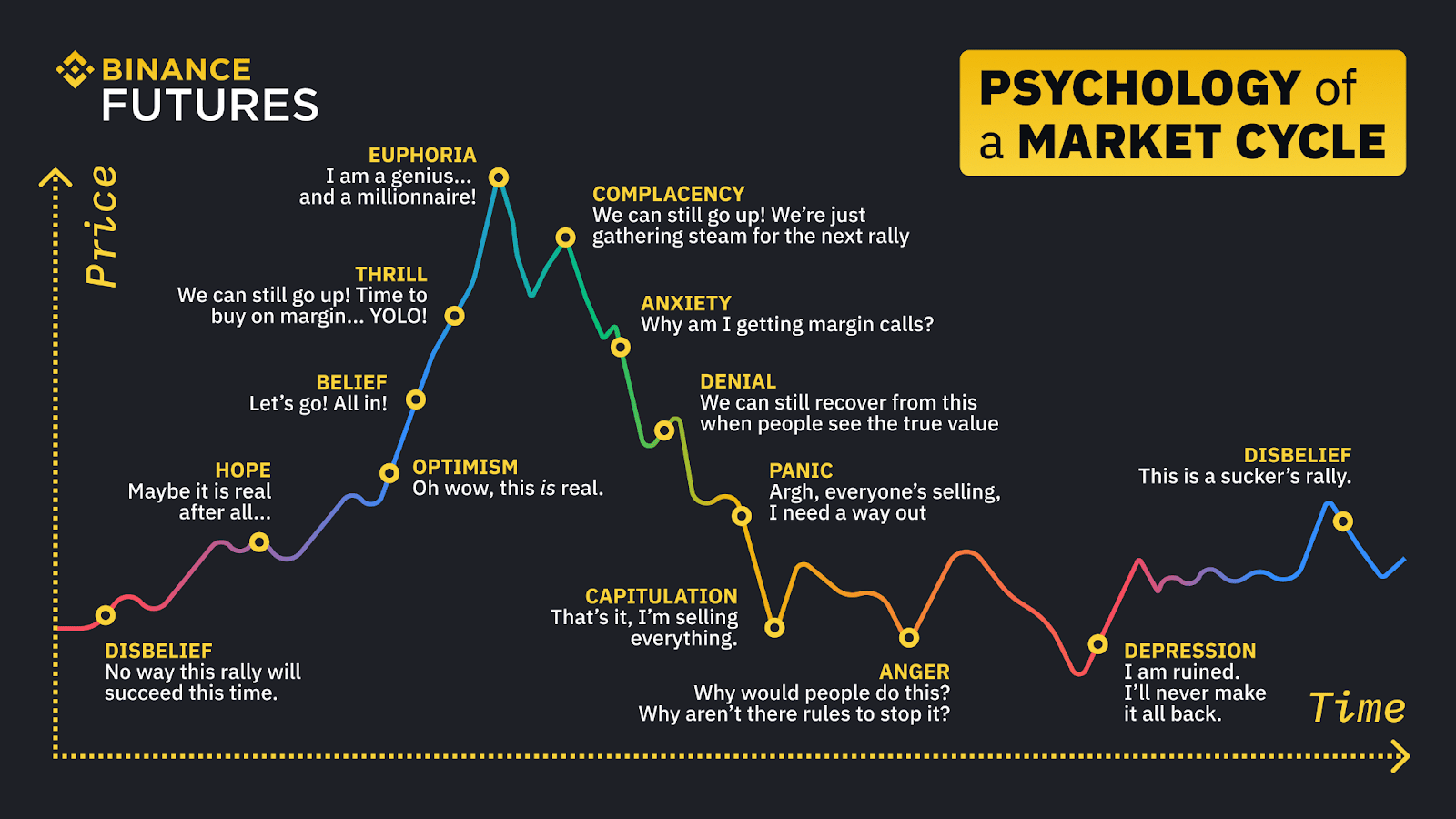

The world of Bitcoin trading is not only shaped by technical analysis and market trends but also by the emotions of those who participate. Emotions such as fear, greed, excitement, and FOMO (fear of missing out) can significantly influence trading decisions, sometimes leading to impulsive actions that deviate from a well-thought-out strategy.

Exploring Common Emotions in Bitcoin Trading

Let’s examine some common emotions that traders experience and their potential impact:

1. Fear and Panic

Fear can lead to panic selling, causing prices to plummet. Understanding how fear manifests and learning to manage it is essential for maintaining a steady hand in turbulent times.

2. Greed and Overconfidence

Greed and overconfidence can result in chasing unrealistic gains or taking on excessive risks. Recognizing when these emotions arise can help traders avoid making rash decisions.

3. Excitement and FOMO

Excitement and the fear of missing out (FOMO) can drive impulsive buying, often at the peak of a price surge. Developing a disciplined approach helps mitigate the influence of excitement on decision-making.

4. Impatience and Hasty Actions

Impatience can lead to premature actions, such as closing positions too early or overtrading. Patience and a long-term perspective are crucial in the world of Bitcoin trading.

Strategies for Emotionally Intelligent Bitcoin Trading 코인선물

Navigating the emotional roller coaster of Bitcoin trading requires emotional intelligence and disciplined strategies:

1. Establish Clear Trading Rules

Establishing precise entry and exit points, along with implementing stop-loss and take-profit levels, is crucial. By adhering to predefined rules, one can effectively mitigate the influence of emotions on their decision-making process.

2. Practice Mindfulness and Self-Awareness

Cultivate self-awareness to recognize when emotions are influencing your decisions. Mindfulness techniques can help you stay present and make rational choices.

3. Maintain a Trading Journal

Maintain a trading journal to meticulously monitor your emotions, decisions, and results. This critical analysis will offer valuable revelations into your emotional tendencies and aid in refining your methodology.

4. Embrace Risk Management

By incorporating effective risk management techniques like position sizing and diversification, you can safeguard your investment capital and reduce the emotional stress associated with potential losses.

The Future of Emotionally Intelligent Bitcoin Trading

Harnessing the power of AI technology, the future of Bitcoin trading holds immense potential. Imagine tools that can analyze emotions in real time and assist traders in comprehending their emotional state. With this newfound insight, traders can receive strategic guidance to curb impulsive actions. Embrace a smarter approach to cryptocurrency trading with AI-driven solutions.

Conclusion: Mastering Emotions for Bitcoin Trading Success

Mastering the world of Bitcoin trading: the art of emotion and intellect. Gain a deep understanding of the psychological nuances that drive trading decisions. Transform your approach with effective strategies to tame emotions. Embrace the truth that triumph in trading demands not only technical prowess, but emotional intelligence, discipline, and unwavering resilience.