Futures trading is a dynamic world that presents lucrative prospects for sharp 선물옵션 traders willing to delve deep into the markets. A seasoned sense of timing is key when navigating this field successfully. One tool traders can ensure profitability with is seasonality. This article delves into how traders can use seasonality to enhance their futures trading, providing practical tips to incorporate this powerful tool strategically.

What is Seasonality in Futures Trading?

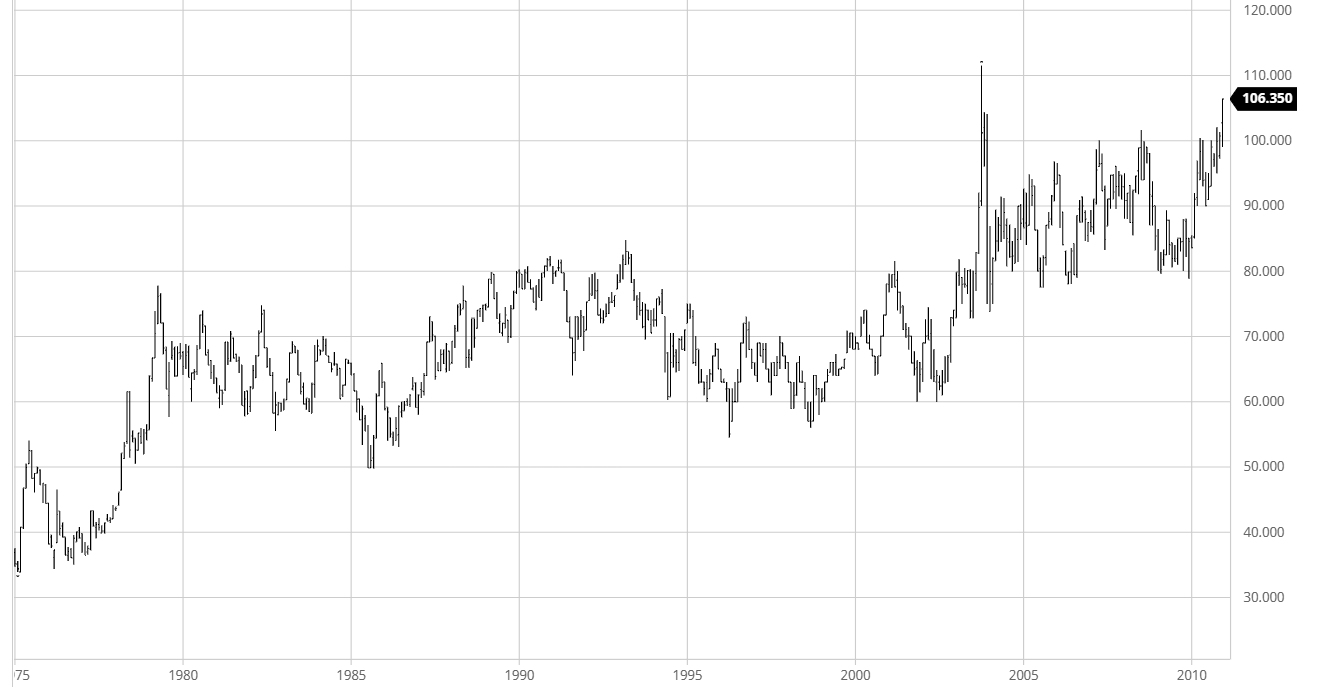

Seasonality is the phenomenon where certain markets consistently follow 해외선물커뮤니티 a pattern of behavior at particular times of the year. This can be attributed to various factors like climate, festivities, or cycles. A classic example is the surge in natural gas prices during winter months when heating requirements upsurge. Similarly, grain prices escalate during the planting season in spring.

Enhancing market insights requires a deeper understanding of its historical patterns. While not a foolproof method, seasonality can shed light on market behavior and aid in informed trading decisions.

How to Use Seasonality in Futures Trading 해외선물

Discovering the seasonal secrets of futures trading involves finding markets that showcase patterns over time. Traders can exploit historical price data to detect these patterns by using resources such as government reports, publications, and databases. With an astute understanding of seasonality, the trading game becomes a whole lot smarter.

Identifying and exploiting market seasonality is key to successful trading. Taking advantage of patterns in market behavior, such as entering and exiting at the right times, can make all the difference. Traders can use seasonality as a confirmation signal along with other indicators, making informed decisions to maximize their returns. For example, waiting to enter a trade until the start of a historically strong period may be a wise move, even if technical indicators suggest otherwise. Implementing a strategic approach to seasonality can lead to a competitive edge in the market.

Practical Tips for Using Seasonality in Futures Trading

Here are some practical tips for traders looking to incorporate seasonality into their futures trading strategy:

- Research the markets you are interested in trading and identify 해외선물대여계좌 which ones exhibit seasonal patterns.

- Use historical price data to identify the seasonally strong and weak periods for each market.

- For instance, changes in the price of crude oil can have ripple effects on heating oil prices. So, it’s worth keeping an eye on related markets to stay ahead of the curve.

- Use seasonality as a confirmation signal for other trading indicators.

- Be prepared to adjust your strategy if market conditions change. Seasonality is not a guarantee, and unexpected events can disrupt historical patterns.

Conclusion

Utilizing seasonality can prove to be a useful asset for those in the futures trading 해외선물이란 business. By recognizing which markets showcase repeating patterns throughout the year and developing a trading formula that capitalizes on said patterns, traders can make smarter, more informed moves and raise their earnings. It is crucial to always conduct thorough research, test your approach, and be ready to adapt to shifts in the market to be successful.